Times Interest Earned TIE Ratio: Definition, Formula & Uses

Content

Calculate the Times interest earned ratio of Apple Inc. for the year 2018. This means that Tim’s income is 10 times greater than his annual interest expense. In this respect, Tim’s business is less risky and the bank shouldn’t have a problem accepting his loan.

- To better understand the TIE, it’s helpful to look at a times interest earned ratio explanation of what this figure really means.

- For instance, if the ratio is 4, the company has enough income to pay its interest expense 4 times over.

- As with most fixed expenses, if the company is unable to make the payments, it could go bankrupt, terminating operations.

- Divide EBIT by interest expense to determine how many times interest expense is covered by EBIT to assess the level of risk for making interest payments on debt financing.

- Therefore, the firm would be required to reduce the loan amount and raise funds internally as the Bank will not accept the Times Interest Earned Ratio.

- The times interest earned ratio measures the ability of a company to take care of its debt obligations.

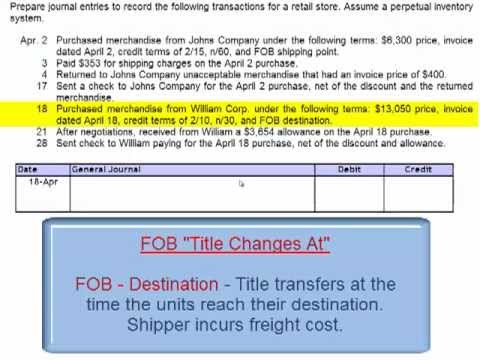

As a result, it will be easier to find the earnings before you find the EBIT or interest and taxes. The times interest earned ratio measures the long-term ability of your business to meet interest expenses. The times interest earned ratio, or interest coverage ratio, measures a company’s ability to pay its liabilities based on how much https://online-accounting.net/ money it’s bringing in. The ratio indicates whether a company will be able to invest in growth after paying its debts. In some respects, the times interest earned ratio is considered a solvency ratio. Since interest and debt service payments are usually made on a long-term basis, they are often treated as an ongoing, fixed expense.

Times Interest Earned Ratio Conclusion

You’ll find articles on starting a small business, name registration, and more. Please note that EBIT represents all of the profits your business earned during the relevant accounting period. What’s more, higher disposable income means that you are in a better position for growth. Obviously, when you have the operating expenses to reinvest in your business, it shows you are performing well. A solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt and other obligations. Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock.

Like any metric, the TIE ratio should be looked at alongside other financial indicators and margins. The balances of the amount of debt borrowed from financial lenders or created through bond issuance, less repaid amounts, are included in separate line items in the liabilities section of the balance sheet. Further, the Company may be bankrupt or have to refinance at the higher interest rate and unfavorable terms. Thus, while analyzing the solvency of the Company, other ratios like debt-equity and debt ratio should also be considered. In other words, a ratio of 4 means that a company makes enough income to pay for its totalinterest expense4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year.

Step 3. Times Interest Earned Ratio Calculation (TIE)

The times interest earned ratio, also known as the interest coverage ratio, measures how easily a company can pay its debts with its current income. To calculate this ratio, you divide income by the total interest payable on bonds or other forms of debt. After performing this calculation, you’ll see a number which ranks the company’s ability to cover interest fees with pre-tax earnings. Generally, the higher the TIE, the more cash the company will have left over. Times interest earned ratio is a solvency ratio indicating the ability to pay all interest on business debt obligations.

Said differently, the company’s income is four times higher than its yearly interest expense. Suppose for a company the quarterly EBIT is Rs350 crore and the total interest expense for the company is Rs 50 crore then calculate the times interest earned ratio for the company. Let us take the example of a company that is engaged in the business of food store retail. During the year 2018, the company Times Interest Earned Formula registered a net income of $4 million on revenue of $50 million. Further, the company paid interest at an effective rate of 3.5% on an average debt of $25 million along with taxes of $1.5 million. Calculate the Times interest earned ratio of the company for the year 2018. However, smaller companies and startups which do not have consistent earnings will have a variable ratio over time.